Professional Employer Organization

Access more top-rated insurance companies

Get better advice and faster

turn-around on insurance quotes

Prefer to speak with A Professional Employer Organization Specialist?

Give us a call today at 1800-411-0733

Professional Employer Organization USA

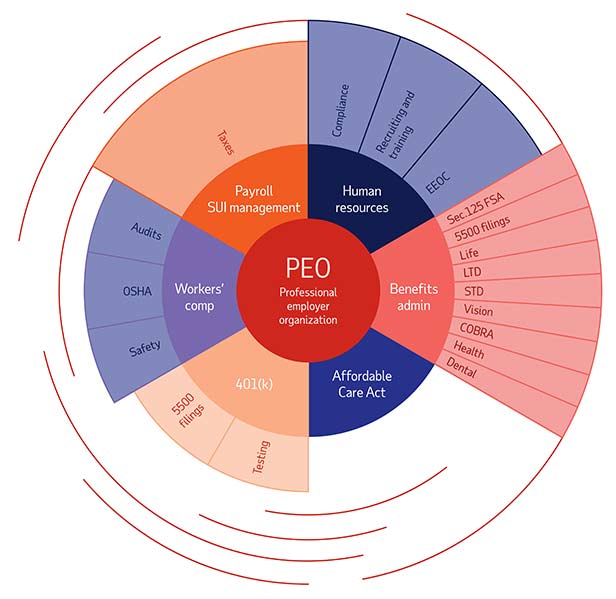

Businesses of all sizes can benefit from the comprehensive HR, benefits, payroll, and compliance services provided by a professional employer organization (PEO)… By outsourcing these complex, time-consuming, and generally burdensome owners of small businesses can use their time and energy more effectively by outsourcing administrative tasks to Professional Employer Organizations (PEOs). Finding the best PEO for your company can be difficult, given that there are over 900 of them operating in the United States.

Unlike traditional HR outsourcing services, PEOs operate on a co-employment model, which means your employees are considered to be on the “books” of the PEO for the purpose of taxes and legal obligations. With the ability to employ hundreds of thousands of people, PEOs can operate like huge corporations. PEOs can negotiate better rates on unemployment and workers’ compensation insurance with employee benefits providers. It also gives them the ability to create and use powerful time-tracking and payroll software for small businesses.

The customer success managers (and other team members) of a PEO will work closely with you to build the services you need for your small business. Your PEO can adapt to meet your changing needs as your business grows. In the co-employment model, you’re working with a team of experts to build out your organization’s administrative and back-end processes.

If your business is financially viable, these organizations can relieve you of much of the burden of running it, allowing you to focus on more urgent matters.

Nearly 175 thousand small and medium-sized businesses rely on professional employer organizations (PEOs) for quality benefits and human resources (HR) support in order to operate efficiently. Because PEOs must abide by both state and federal regulations, some are segmented by state or region.

Remember that some PEOs are only qualified to serve small businesses in certain states, whereas others have global partnerships. We found that most of the companies we looked at are licensed to sell insurance in every state. Check the National Association of Professional Employer Organizations (NAPEO) directory to see whether a particular professional employer organization operates in California.

Why Quote Workers' Compensation Insurance With Us?

Because Well-Informed Agencies Assign Advice and Added Alternatives Affair.

PEOs process payroll and in some cases can pay original, state, and civil employment levies. Numerous also integrate payroll with time and attendance, which helps reduce indistinguishable data entries and crimes.

Aco-employment arrangement frequently comes with access to high-quality, cost-effective health insurance, as well as dental care, withdrawal benefits, and other hand gratuities. The PEO will generally handle the hand registration for these benefits and process

In addition to workers’ compensation insurance, PEOs occasionally give safety checkups and training programs to help you limit claims. They may also help with Occupational Safety and Health Administration (OSHA) examinations.

Benefits Of Professional Employer Organization Services

For small business owners and their employees, PEOs offer a number of advantages. For one thing, you can offer your employees affordable health insurance benefits that you would otherwise be unable to afford. Since most PEOs have hundreds or even thousands of employees, they are eligible for special pricing. Additionally, PEOs can provide your employees with disability and life insurance plans, as well as a variety of other fringe benefits, such as transportation reimbursement. Competitive benefits like these help you attract and retain top talent, making you a more attractive employer.

In addition, PEOs have reputable administrative services that are especially helpful for small business owners who already wear many hats and don’t have the time to deal with all the paperwork required. This means that you can concentrate on other aspects of your business and rest assured that all of your employees are being properly cared for and supported by PEOs. Payroll tax regulations, unemployment insurance, workers’ compensation coverage, and workplace training for your employees are all provided by PEOs, as well.

In order to hire and retain employees, many small businesses partner with a professional employer organization (PEO). Offering healthcare and other hard-to-find benefits becomes increasingly important as your company grows and needs to hire more employees.

High-quality benefits aid in the recruitment and retention of capable, conscientious workers. When it comes to bringing in new employees, PEOs take the stress and legal paperwork off of the new hires’ shoulders. They can also assist your company in complying with federal and state regulations throughout your HR processes.

If you’re looking for help with your human resources, you’ll find it in a Professional Employer Organization (PEO) in New Jersey. In terms of HR support, PEOs are flexible enough to meet your needs on an as-needed basis. Employee handbooks and policies, employee onboarding and termination, unemployment assistance, as well as compliance reporting can all be handled by HR specialists. Typically, their features can be accessed via user-friendly online platforms and mobile-friendly apps. All of your HR functions can be accessed from one central location with the help of these platforms.

Professional Employer Organization For Small Business

Most often, PEOs serve small and medium-sized businesses by handling their human resources needs. PEOs have some drawbacks, but they can manage HR functions like employee training and development, risk and compliance, workers’ compensation, payroll, and benefits, with some offering these services bundled in a predetermined package and others offering customizable plans with a la carte features.

As a general rule, most small-business owners don’t have the resources or knowledge necessary for comprehensive human resources management (HR). One of those people is likely to benefit greatly from the services of a professional employer organization (PEO).

Payroll service providers (PEOs) can help you focus on more strategic, revenue-generating aspects of your business by handling routine administrative HR tasks and compliance requirements.

How can a PEO help my Business?

- You may be able to reduce some of the costs and liabilities associated with being an employer by sharing some of your responsibilities with a PEO.

- The use of PEOs, or Professional Employer Organizations, has become increasingly common in the United States. Small businesses with five to one hundred employees can greatly benefit from using a PEO to handle their human resources needs.

- Small business owners can save money by using a PEO instead of hiring a full-time accounting staff. Additionally, it allows business owners to concentrate on the day-to-day running of their company, rather than having to deal with complicated HR paperwork and compliance issues. According to the National Association of Professional Employer Organizations (NAPEO), businesses using a PEO saw the following incredible results:

- Growth of up to 7-9 percent.

- Businesses that are more likely to stay in business are 50% more likely to succeed.

- Reduced staff churn of 10%-14%

- It’s not just in the long run that using a PEO can benefit a small business, but it also has numerous short-term benefits.

We Provide Professional Employer Organization

Cover their medical care

Replace utmost of their lost stipend if they take time off from work to recover

Give death benefits, like helping pay for burial if they lose their life in a work-related accident

Getting Workers' Comp Quotes

Getting Started

Where you can get a workers’ presentation insurance quotation:-

- Direct from the insurance carrier (you can request a quotation from us online or by calling 1800-411-0733

- Through an insurance agent.

- Through your state’s assigned threat plan (this is generally when you’re unfit to get content from another carrier)

Getting Started

| You Federal Employer Id Number |

|---|

| Loss runs for prior 3 years (if applicable) |

| Supplementals and No Loss Affidavits may be requested |

| * New business coverage available for most classes |

Professional Employer Organization for Business

Improve cash flow with our national Pay As You Go Workers' Compensation. Reduce the cost of getting started and pay premium based on actual wages.

Get quotes for the toughest NCCI class codes and higher experience modification rates with partners that specialize in high hazard industries.

Enjoy special terms with partners offering more flexible payment options like 12 equal installment plans and monthly reporting.