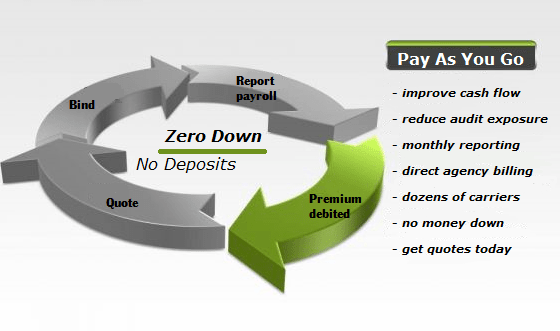

Pay As You Go Workers Compensation

For your Brighter Days Get the Better Insurance Our Preference Customer satisfaction is important.

Prefer to speak with A Pay As You Go Workers Compensation Specialist?

Advantages of Pay-as-you-go Workers Compensation

How Pay-As-You-Go Workers' Comp Benefits Your Company?

Workers’ compensation Pay As You Go minimizes large premium deposits, lowers audit risk, and improves cash flow.

Small businesses, now more than ever, require practical solutions to help them lower insurance costs and increase cash flow. Workers’ Compensation Insurance on a Pay-As-You-Go basis allows business owners to carry workers’ compensation with little or no upfront costs. Because premium payments are based on real-time payroll wages and reporting, our Pay As You Go systems help firms avoid big audit bills. With more insurance partners than any other agency, we’re the national leader in Pay As You Go coverage. Compare quotes from more than a dozen Pay-As-You-Go insurance providers.

Do I Qualify for Workers' Compensation on a Pay-As-You-Go Basis?

With one or more of our insurance companies, most businesses qualify for Pay As You Go coverage. Businesses with at least two employees and an annual premium of $650.00 or more are often qualified for one or more of our plans. We’re appointed with over 45 insurance providers as the national leader in Pay As You Go work comp. More than 15 of our partners currently accept Pay As You Go in payments.

Why Quote Pay As You Go Workers Compensation With Us?

Because Well-Informed Agencies Assign Advice and Added Alternatives Affair.

PAYG enables you to pay accurate decorations because they ’re grounded on your factual payroll each time you run it. So, there’s no down payment or deposit like you would pay with a traditional workers’ presentation policy. Rather, your payments are spread throughout the course of the time, creating a healthier cash inflow for your business.

PAYG connects dead to your authentic-moment payroll data every moment you dash payroll. beautifiers advance with a series of constant compensations that are automatically and dead computed alongside your custom’s payroll agenda – whether that’s biweekly or monthly, etc. This robotization will deliver you a moment so you can condense your precedences.

With Pay As You Go, your end-of-time workers’ presentation checkups come a breath. In utmost cases, there won’t be an annoying, time-consuming inspection to true-up your worker's comp decoration. Because your decoration was grounded on your factual payroll during the time, you alleviate the need for a painful inspection. There’s no overpaying or underpaying, and your cash inflow won’t take a time-end megahit.

START YOUR QUOTE TODAY - LEAVE THE SHOPPING TO US

Pay as you go Workers’ Compensation USA

This type of workers’ compensation insurance is becoming more and more popular in the workplace. To reduce upfront costs and outdated payment methods, many businesses are turning to pay-as-you-go for workers’ compensation insurance in order to save money. Since the workers’ compensation premiums are calculated based on actual payroll data rather than an estimate for the entire year, pay-as-you-go is more accurate when making payments than the estimated annual total. The risk of paying too much in premiums over the course of the year is reduced, as is the possibility that under-reported payroll will result in a premium* adjustment at the policy’s end.

Workers’ compensation insurance with pay-as-you-go options is just another way to pay your premiums. You don’t get rid of your workers’ compensation insurance or your responsibility to pay premiums, collect/issue certificates of insurance from subcontractors, etc. with this new insurance. A state-approved workers’ compensation insurance carrier or an approved self-insured source must still provide your coverage.

However, there are compelling reasons why small businesses should consider the pay-as-you-go method of paying workers’ compensation insurance costs. In this module, you’ll learn about a few of the most significant.

How Pay As You Go Workers' Comp Helps Your Business?

To help small businesses save money on insurance and improve their cash flow, real solutions are needed. For small or no money down, business owners can carry workers’ compensation through Pay As You Go workers’ compensation plans Employers benefit from our Pay As You Go programmes because premium payments are based on actual payroll wages and reporting.

We have more insurance partners than any other agency in the country when it comes to Pay As You Go coverage. Rates for Pay As You Go insurance can be found from over a dozen different providers.

Is Pay as you go Workers’ Compensation is Beneficial?

Pay as you go is an excellent emergency payment option because it is automatic. As an alternative to paying for a year’s worth of insurance at once, you can pay for a week or two of coverage at a time. There will be additional funds available for other business-related activities, such as vendor contracts, helping the local community, or expanding into new markets during times of crisis. Your company and employees will benefit greatly if you can reduce insurance costs without sacrificing coverage.

It’s possible to make more money by investing the extra cash flow if you’re able to do so. Thus, your employees will be better prepared for any future policy changes or procedures that may be implemented. You’ll also have the flexibility to make additional equipment purchases if necessary. Your own money can help in the long run by allowing employees to continue to work from home during a crisis, even if they don’t have the necessary equipment. With some insurance companies’ pay-as-you-go options, you can keep those funds available by only paying for what you’ve actually paid, not what you’ve estimated. Furthermore, you won’t have to alter your current policy if you do have to lay off some employees. An additional benefit is that, if an audit is required, it should come out at the same time so that you don’t have to worry about racking up a large bill.

Pay for what you use Compensation for Employees in Times of Crisis

In times of crisis, having an essential business or the ability to work entirely from home can be advantageous. Unexpected events can have a financial impact on even the most essential businesses, forcing you to devise new strategies for surviving and overcoming potentially devastating situations.

If your business is facing financial difficulty, there are ways to reduce costs and increase cash flow in all areas of your operations. But what about insurance? The ability to purchase workers’ compensation insurance on an as-needed basis can be a lifesaver for small businesses facing difficult financial times.

When an unexpected event occurs, crisis management is the first thing that comes to mind. Is it possible for our business to withstand this crisis? Will this have an adverse effect on our financial position? Is there a chance that we will have to lay off employees?

What are my options for keeping up with payments to my vendors? In times of crisis, all of these things will cause stress, but it is imperative that you remain calm and persevere as best you can. The pay-as-you-go option for Workers Compensation can help your company’s cash flow and keep more employees on the payroll.

We Provide Pay As You Go Workers Compensation

Cover their medical care

Replace utmost of their lost stipend if they take time off from work to recover

Give death benefits, like helping pay for burial if they lose their life in a work-related accident

Getting Started

Where you can get a workers’ presentation insurance quotation:-

Direct from the insurance carrier (you can request a quotation from us online or by calling 1800-411-0733

Through an insurance agent.

Through your state’s assigned threat plan (this is generally when you’re unfit to get content from another carrier)

Getting Started

| You Federal Employer Id Number |

|---|

| Loss runs for prior 3 years (if applicable) |

| Supplementals and No Loss Affidavits may be requested |

| * New business coverage available for most classes |

Pay As You Go Workers Compensation for Small Business

No Money Down

Improve cash flow with our national Pay As You Go Workers' Compensation. Reduce the cost of getting started and pay premium based on actual wages.

Competitive Price

Get quotes for the toughest NCCI class codes and higher experience modification rates with partners that specialize in high hazard industries.

Easy Payment Plans

Enjoy special terms with partners offering more flexible payment options like 12 equal installment plans and monthly reporting.